Invest in Main Street, not Wall Street.

Discover passive income investments in small businesses across America. Build a diversified portfolio of breweries, restaurants, shops, real estate projects, and more— in your backyard or across the country.

Tangible businesses, real returns

Rather than employing a traditional interest rate, Revenue Sharing Notes on Mainvest utilize an investment multiple, which is a predetermined amount to be returned to investors by a set maturity date. The key element that differentiates this model is that the return rate correlates directly with the business's gross revenue. This means that returns are tied directly to the performance of the business, creating a system where the investors and the business are working towards mutual success. Through Mainvest, you're not just an investor but a part of the business's journey.

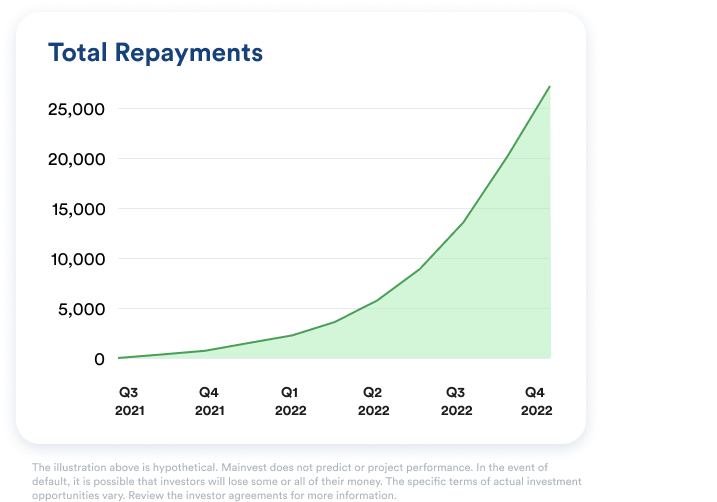

Quarterly repayments*

Historically inaccessible asset class

Average 10-25% target potential returns**

No investor fees

All issuers on Mainvest have unique terms and may not follow the revenue sharing structure as described. All investment involves risk and Mainvest never guarantees that a business will generate revenue or make repayments.

Our Vetting Process

Mainvest has a responsibility to protect investors. Learn why only ~5% of businesses that sign up for our platform are chosen to raise.

Mainvest does not recommend securities nor provide investment advice. Please review all information prior to making investment decisions. All investment involves risk. Do not invest more than you can afford to lose.

Customize your portfolio with an emerging asset class

Make informed investment decisions based on your own interests and strategy. Invest based on location, industry, and risk appetite. Easily compare terms and qualitative data.

"I believe if we all get together and rally around smaller businesses - usually the biggest drivers of economic growth - our local communities will thrive and we can all prosper. Big banks and wealthy investors should not be the only ones to decide which ideas are worth funding."

-Repeat Mainvest Investor

Helpful Resources

Small business crowdfunding was made legal in 2015 by the Regulation Crowdfunding model. This has empowered hundreds of entrepreneurs on Mainvest who have raised over $30M from 30k+ investors across experience and income levels.

❓ FAQs

*While many offerings follow a quarterly repayment schedule, not all offerings do. Furthermore, returns are never guaranteed. Review each offering's individual terms before investing.

**Target return is not a set term and should not be used as such. Due to the nature of the revenue sharing note, the actual return varies over time. This is an estimation using the average projected return profile of most offerings on Mainvest. All offering data and investment terms can be found in the data room.