Financial projections are the best estimate of how much money your business will make and spend over the next three to five years. A good set of projections can show lenders that you have done your homework and that you will manage their investment wisely.

To get started working on your financial projections use this link to our financial projections spreadsheet then click "file" in the upper left corner and "download."

Projections can also provide a valuable benchmark to see whether your business is performing in line with your initial expectations. By comparing your actual results with your projections, you can adjust your business plan to fit better with the practical reality of operations and identify new ways to grow.

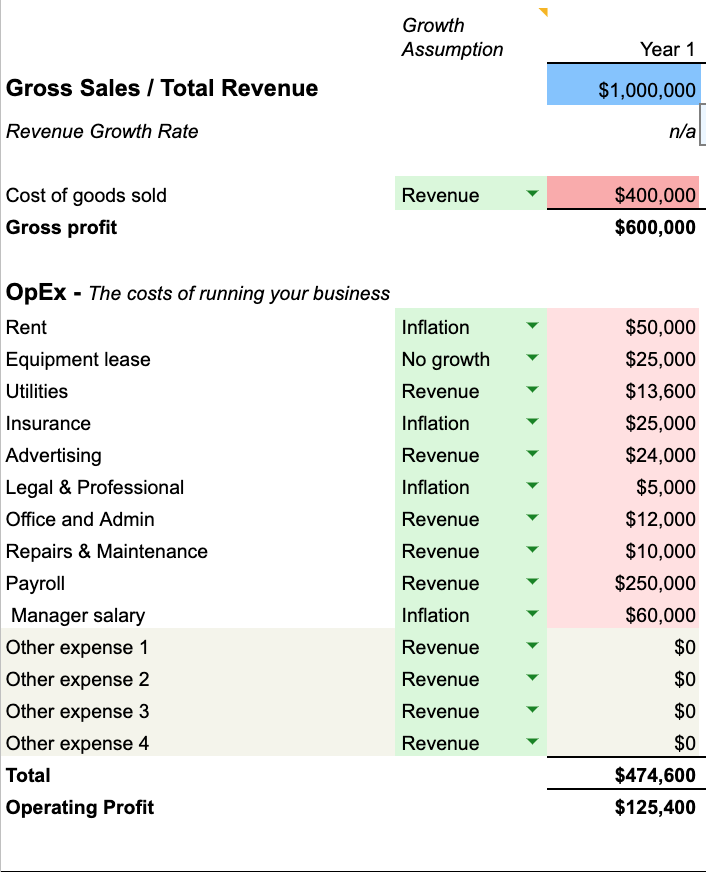

Start with an Income Statement for Year 1. An income statement projects how much money your business will generate by making educated guesses about where revenue will come from, the cost of goods sold, and where it will be spent.

For established companies, it is a good idea to include the actual results of your operations in prior years. This allows you to fine-tune your projections and make sure that they are in line with past results.

Every projection is different, so it is OK to feel more confident about certain forecasts and less confident about others. The goal is to paint an accurate picture of what could happen, based on educated guesses with a foundation in fact.

Predicting Revenue

If you are having trouble predicting your revenue, there are a few ways to tackle it. Can you predict how many customers will visit your store each day? One way to estimate how much foot traffic your store will get is by looking at other similar stores in your area. You don't have to go sit at another store for a whole day but take an educated guess based on how many people you see walk into a store in a given 30 minute period.

Once you know how many people will enter your store, try to predict how much each person will spend or your revenue per a customer. What will they spend that money on? By listing out the different ways that you generate revenue, you can start to think about how you can increase revenue per customer.

Develop long-term projections from your income statement. Completing the income statement for your 1st year will give you a good idea of your company’s short-term expectations. The next step is to project how your business will perform farther into the future.

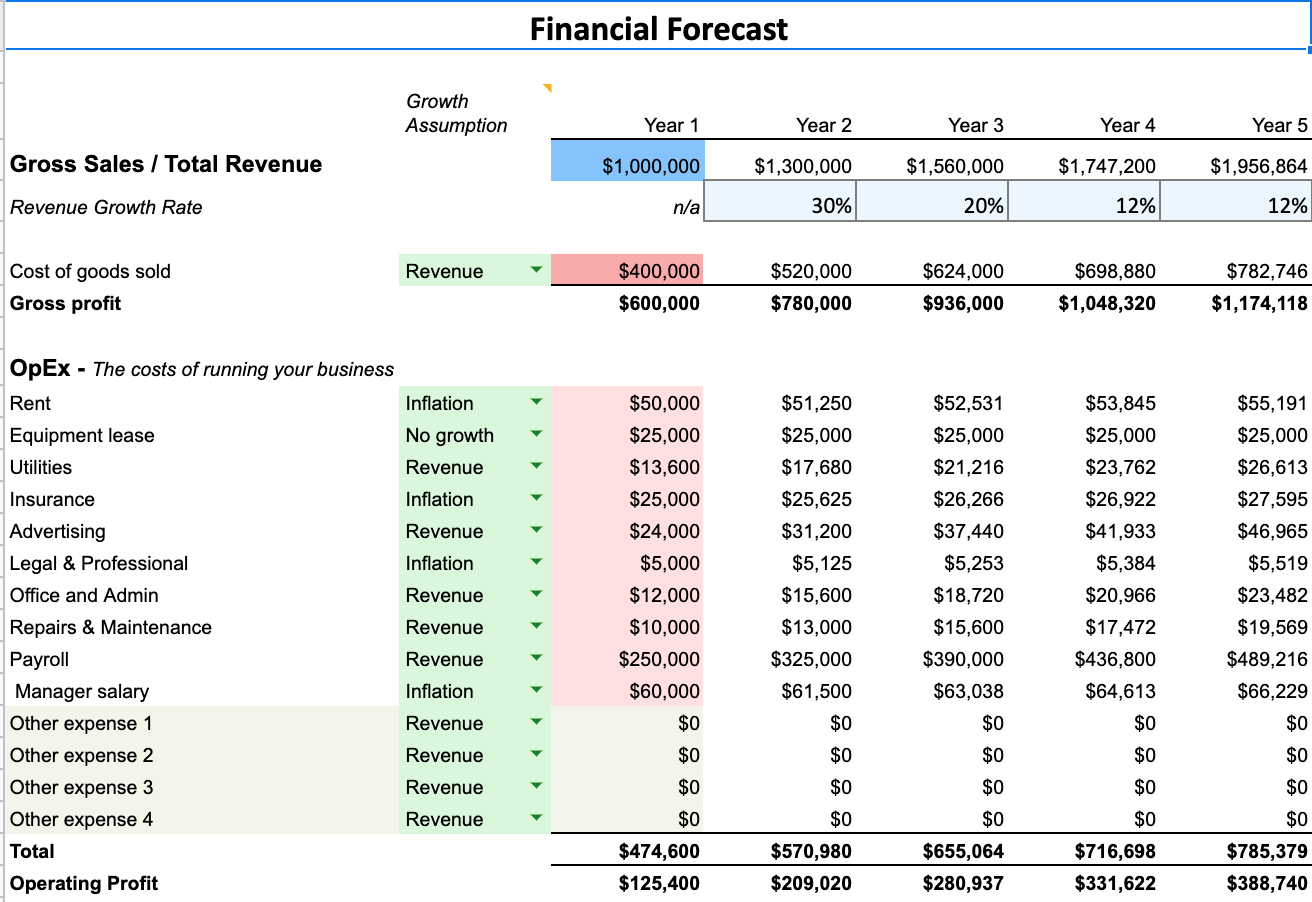

Here is an example of 5 year financial projections. They started by predicting their year 1 revenue and then assumed that they would grow 30% in year 2, 20% in year 3, 12% in year 4 and 12% in year 5. Those are fairly conservative growth estimates. Unless you have some genius marketing plan and plan to invest heavily into marketing and advertisement, I think those are good estimates for most small businesses.

Examine your income statement and go line-by-line asking how much each item will change in the next year, and, more importantly, why it will change. Keep in mind that you need to have an answer if someone presses your assumptions. You should be able to justify every change to revenue or expenses, but your explanation doesn’t have to be bulletproof. Sometimes the answer is simple (e.g. raising prices), but other things will require a more complex explanation (e.g. we anticipate recurring contracts from customers we will gain in year 2).

Projections are ultimately based on assumptions, so don’t get frustrated if you can’t answer certain questions until you are up and running. Go back to the market research you performed to develop your business plan. Look at comparable companies and see how they handle the issue.

Many larger companies will routinely disclose financial information to the general public. This can be a great way to find information on how the other players in your industry are planning to grow, and can provide insight into the big picture for your small business.

If this seems intimidating, know that you are not alone. At Mainvest, we help entrepreneurs navigate the fundraising process every day. We can walk you through the process and answer any questions you have along the way.

If you have any questions about this article, or to see how Mainvest can help your business, please contact a representative at info@mainvest.com.